BHIM App How to Download All Mobiles Aadhaar App

BHIM App How to Download All Mobiles Aadhaar App

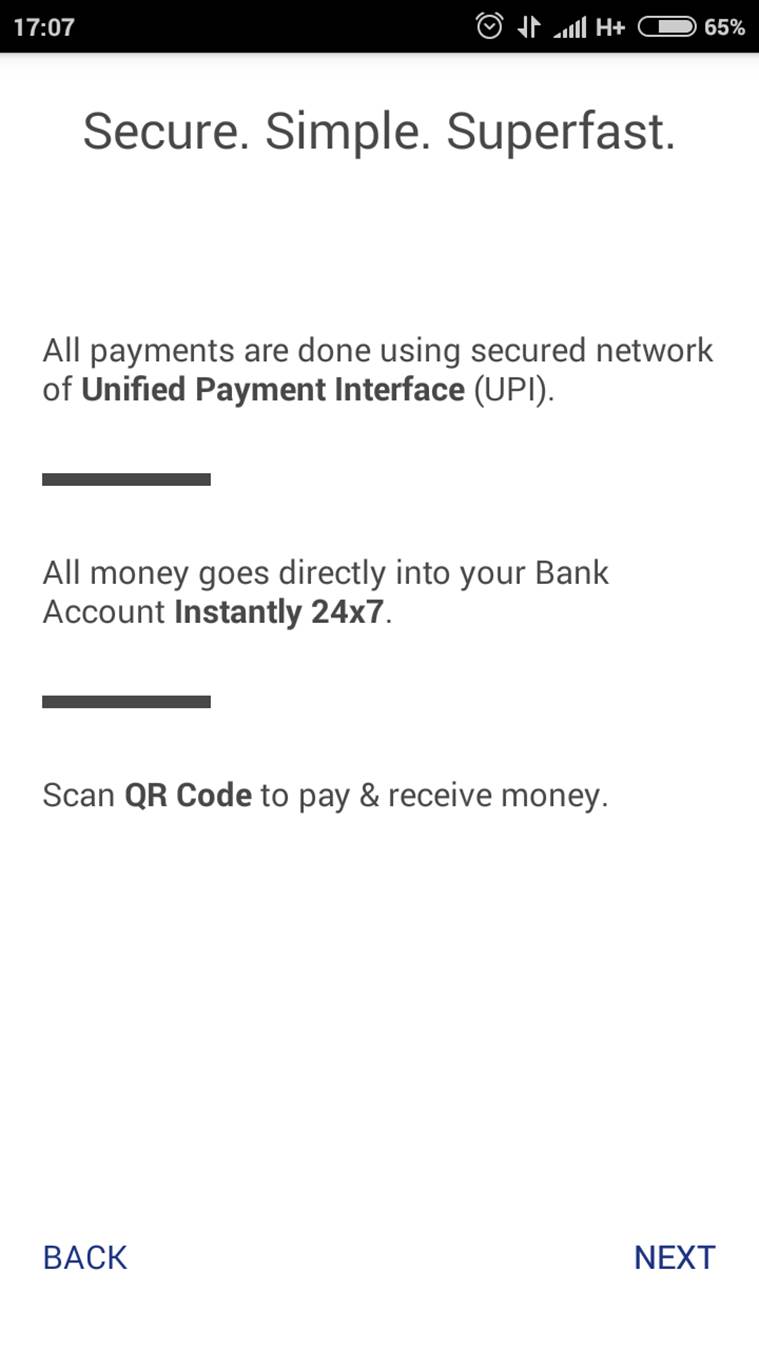

BHIM app, also known as The Bharat Interface in Money The Narendra Modi government’s newest application to encourage India toward a cash-free or a ‘less-cash’ economy. Prime Minister Narendra Modi today launched the application BHIM, which is available on Android OS. An iOS (Apple) app is expected to launch shortly. The government says that the BHIM app will allow users to make cashless transactions via mobile phones in the most “fast, secure, and reliable” method.

The Aadhaar-based payment app is created in collaboration with the National Payment Corporation of India (NPCI). The “Made in India” app can be used conjunction in conjunction with the various Unified Payment Interface (UPI) applications as well as bank accounts.

BHIM Aadhaar app is only for merchants that allow them to obtain bills and payments from customers who do not have cash or cards with only an Aadhaar Identification Number as well as a fingerprint. It is important to note that you don’t need to pay a commission, or surcharges if you’re paying using the Aadhaar Pay app. BHIM Aadhaar Pay is a biometric application that can be connected to biometric finger printers.

1. Where can I download the Bhim app?

Salary WhatsApp Payroll, Early employment, employer, EarnedWage Access

Payroll on demand! Receive your salary from the employer in real-time before the payday

PPF deposit news

Public Provident Fund deposits jump 134% over 9 years: 5 characteristics to make PPF attractive

New labor code of conduct

How Much Money Do You Have? What are the latest labor codes mean for salaried

Here’s what customers who are new to credit must know

With credit card spending increasing Here’s what credit card users who are new to the market must know.

You can download the app from here: https://play.google.com/store/apps/details?id=in.org.npci.upiapp

2. How do I use the Bhim app?

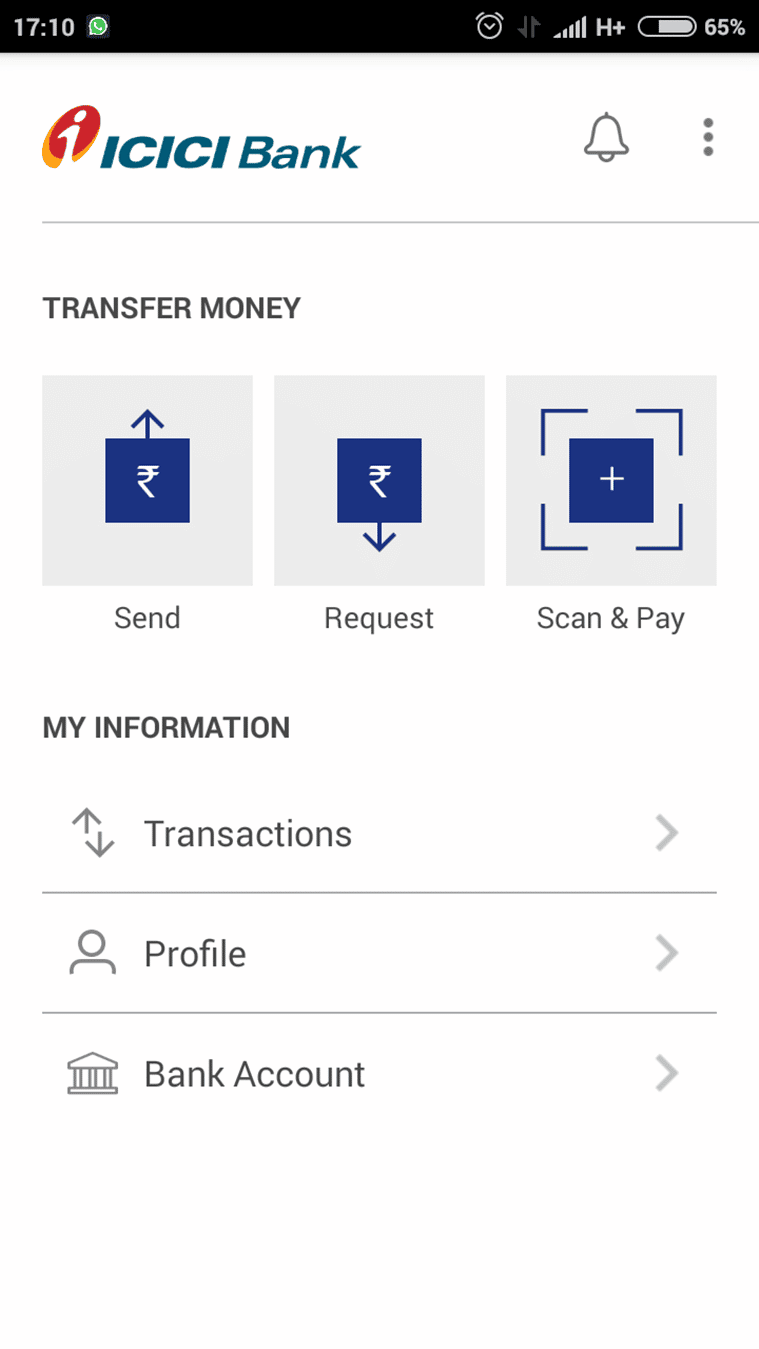

Once you have downloaded the BHIM application on the Play store users must create a bank account, and then set up UPI Pin for it. The mobile number of the user will be used as the payment account. Once you’ve registered, you’re able to begin to transact via the BHIM application.

3. What can I do to transfer or receive money with the BHIM application?

The user can send cash to relatives, friends, and customers via the use of a mobile number (payment address). Money is also able to be transferred to banks that are not UPI-compliant. This is possible using MMID as well as IFSC. Users can also pay money through the order and reverse payment in the event of need.

Bhim App, Bhim app how to make

Choose your bank account

4. Which banks are compatible with the BHIM application?

The following banks accept the BHIM application. Following are the banks that support the BHIM app. The list was released from the Government: Allahabad Bank, Andhra Bank, Axis Bank, Bank of Baroda, Bank of India, Bank of Maharashtra, Canara Bank, Catholic Syrian Bank, Central Bank of India, DCB Bank, Dena Bank, Federal Bank, HDFC Bank, ICICI Bank, IDBI Bank, IDFC Bank, Indian Bank, Indian Overseas Bank, IndusInd Bank, Karnataka Bank, Karur Vysya Bank, Kotak Mahindra Bank, Oriental Bank of Commerce, Punjab National Bank, RBL Bank, South Indian Bank, Standard Chartered Bank, State Bank of India, Syndicate Bank, Union Bank of India, United Bank of India, Vijaya Bank.

5. Other details

The user can view his/her balance and perform payments on the go. Users can also create an account for payment with a specific address, in addition to a phone number. A QR code is scanned to make it easier to enter payment addresses. Merchants can create their QR codes to display, as the government states. The BHIM app is available in Hindi as well as English languages currently however, the government plans to make it available in additional languages shortly.

How to pay using Aadhaar Card

The NITI Aayog and NPCI have created the “BHIM Aadhaar Pay App” which uses API for the UIDAI The Unique Identity Authority of India as well as the UPI interface. The process for paying and enrollment for Aadhaar Pay can be found below.

First of all, you must have an account at a bank (anyone) either public or private that has been approved by RBI (Reserve Bank of India).

You require an Aadhaar Card, issued by UIDAI. You can receive Ayour’s aadhaar Card Number within one day.

Connect your Aadhaar Card to your Bank Account (s). If there is more than one account at a bank you must join your Aadhaar card with all banks. By the RBI’s new guidelines. The E-KYC is mandatory for the customer. The Aadhaar card has to be linked to the account number so that the Govt. can offer different services directly to you through the bank account.

If your Aadhaar Card is linked to a link – you can look up the Aadhaar card linked status by visiting any ATM, online customer support, or by using Netbanking.

To pay using BHIM’s Pay App you must enter the “Aadhaar Number” 12-digit number and then put your fingerprint sensors (biometric gadget).

Note: According to NPCI, NITI Aayog, and NITI Aayog, this app is highly secure and there is no way for fraud to be carried out.

At the present, around 3 lakh merchants accept digital payment via UPI Aadhaar -based payment, the BHIM app, debit, credit cards, and more. Already, 27 banks have joined the platform, along with 300,000 merchants that are ready to accept digital payment.

What exactly is BHIM Aadhaar Pay referral bonus scheme/cashback?

Answer: To increase the growth of BHIM Aadhaar Digital Payment in villages, Cities the Govt. of India will be giving out Referral Bonuses to Customers and merchants that pay via the biometric Aadhaar Payment system. The amount is 495 crore and will be distributed over six months. With the Referral Bonus Scheme, both the current user who has referred BHIM and the user that is new to the scheme will receive the cash reward directly into their account.

BHIM Aadhaar Pay Cashback offers

Paying using BHIM App and the Aadhaar Based biometric device will give you a cashback of 50/- 100 Rs/1,000 or 20000per transaction based on the amount you use and charge amount. In addition, NITI Aayog and NPCI will offer cashback offers on BHIM App for electronic payment. We are providing daily offers and cashback, referrals bonus details on www. bhimappdownload. on the website. With the Cashback program, merchants can earn cashback for each transaction that is made with BHIM.

BHIM Aadhaar Pay App Cashback, Referral Bonus Schemes

The program was launched on the 25th of December, 2016. Lucky Grahak Yojana and Digi-Dhan Vyapar Yojana is a massive success, having helped 16 lakh, people, over 100 days and awarded the sum of Rs 258 crore to lucky winners of the lotto.

The Aadhaar Enable Payments system has increased to a record in March of 2017. In total, five crores (approx) transactions have made use of payment methods based on Aadhaar. At the present, Prime Minister Modi declared the BHIM Aadhaar Pay is set to be open to every merchant (whether you are in Village or City). The application is free of cost and it is available to download through the Google Store.

Prime Minister Modi has also announced the addition of 75 townships will be upgraded to “less-cash-township” which have used digital payment methods. An estimated 1.5 lakh digital transactions occur each day in these types of towns.

Bhim website – complete details:

What is Bharat Interface for Money?

Bharat Interface For Money is an application that lets you perform simple and fast payment transactions with UPI. It’s simpler than Wallets! You won’t have to fill in those lengthy bank account details over and over again. You can make easy direct bank-to-bank payments and immediately collect funds using your mobile number or address.

What is the speed of a transaction through Bharat Interface for Money?

As quick as it is possible to be! All transactions made through Bharat Interface for Money are tied with your account at a bank, and the transactions are completed in just a few seconds.

Are there any fees for making use of Bharat Interface to transfer money?

There aren’t any fees for transactions made via the Bharat interface for money. Be aware that your bank may nevertheless charge a fee in the form of an IMPS or UPI fee, which is not within our control. Make sure to check with your bank for further information.

Pay and send money

What are the steps I must take to do to begin using Bharat Interface to make money?

Bharat Interface Money application is accessible on Android (Version 8.2 and higher) and iOS mobile phones (Version 5 and up). We’ll be making the app available for other platforms shortly.

Is Bharat Interface to Money compatible with all Mobile OS?

To get started with Bharat Interface for Cash, all you require is a smartphone, Internet access, an Indian bank account that can support UPI payments, and a mobile phone number that is linked to your bank account. Connect your bank account to UPI by using the application.

Do I need to allow Mobile Banking on my bank account to utilize Bharat Interface for Money?

Your account is not activated for mobile banking to make use of Bharat Interface for Money. Your mobile number has been in the database of the Bank.

Do I have to be a customer at one particular bank to access Bharat Interface for Money?

To allow transfers directly from the bank’s account, the bank must be active on the UPI (Unified Payment Interface) platform. All banks that are currently active on UPI are included on the Bharat Interface for Money app.

How do I set up the UPI-PIN to my bank account using Bharat Interface for Money?

You can create your UPI PIN using the Main Menu Banking Accounts – Set UPI PIN for the chosen account. You will be asked to enter the last six digits of your debit/ATM card as well as its expiry dates. Then you will receive an OTP which you must enter and then set Your UPI PIN. Be aware that ‘UPI-PIN’ is not the same as the MPIN that is provided by your bank to enable Mobile Banking.

Can I connect several bank accounts to Bharat Interface to transfer money?

Presently, Bharat Interface for Money allows the linking of one bank only. When you are completing the account setup, you will be able to connect your preferred bank account to your default bank account. If you would like to link a different bank account, open the Main menu, select Accounts for Banks Accounts and choose the account you want to use as your default. Any money that you transfer to you via your mobile number or address will be credited to the default bank account.

What is the reason why my mobile number associated with Bharat Interface for Cash and my number that is associated with my bank account need to match?

It is a banking network (UPI) obligation. The mobile number used to sign up to Bharat Interface for Money is used to match banks that have been linked to it.

Do I need to provide Bharat Interface for Money with my bank account information?

At the time of registration, you’ll provide us with your debit card details, and access to your mobile number that you have linked to the bank account you have, we’ll pull the data directly from your banking institution. All information exchanges take place through secure banking networks and we don’t keep the information, so your data is secure!

Everything you have to be aware of UPI

The Unified Payment Interface(UPI) is a fast payment system that was developed by the National Payments Corporation of India (NPCI) which is an RBI-controlled entity. UPI is built upon the IMPS infrastructure that lets you instantly transfer money between two banks.

What is a UPI-PIN?

The UPI-PIN (UPI Personal Identification Number) is a 4-6-digit secret code you generate or set during the initial registration to this App. You need to enter this UPI-PIN to authorize every bank transaction. If you’ve already created a UPI-PIN in different UPI Apps you can use it for the Bharat Interface for Money. (Note that the MPIN issued by banks differs in comparison to the UPI UPI-PIN. You must create an entirely new UPI-PIN using Bharat Interface for Money. Bharat Interface for Money app) Note: Do not share your UPI-PIN details with anyone. Bharat Interface for Money does not save or read the UPI-PIN information and the customer service of your bank will never request it.

How to check your bank account balance

What is a Payment Address?

The Payment Address is an address that uniquely identifies a particular person’s bank account. For example, the Payment Address for Bharat Interface for Money clients has a format of xyz@upi. It is possible to give your Payment Address to anyone who wants to receive payments (no need for a bank account number or IFSC code, etc.). You may also transfer funds to anyone with the Payment Address. Be careful not to give out your private UPI PIN or to any other person.

What happens if I type in the wrong UPI-PIN in a transaction?

It’s not a problem, the app will prompt you to enter the proper UPI-PIN. The maximum number of attempts allowed is determined by the bank you use. Check with your bank for specifics.

I’ve selected UPI and I have selected the Bank name to connect to UPI however, it doesn’t find my bank’s a/c

In this case, you should check that the mobile phone number that is linked to the bank account you have is the same as the number that you verified in Bharat Interface for Money App. If it’s not identical the bank accounts you have are not able to be accessed through Bharat Interface for Money. UPI platform. In addition, only Savings and Current bank accounts are accepted via Bharat Interface for Money.

What’s wrong with my UPI transaction not working?

If you are shopping online you can pay with UPI if you select UPI as an option to pay. When you click this, you’ll need to enter your payment address (xyz@upi). Once you have entered it, you will be sent a request to collect the Bharat interface for the money application. Enter your UPI-PIN and your transaction is complete. Simple as that!

Do I have to be a customer at one particular bank to access Bharat Interface for Money?

To allow transfers directly from accounts at your banks, the bank has to be on the UPI (Unified Payment Interface) platform. All banks that are currently active on UPI are listed within the Bharat Interface for Money app.

How do I create the UPI-PIN to my bank account using Bharat Interface for Money?

You can create your UPI PIN using the Main Menu Bank Accounts – Set UPI PIN for the account you want to set. You will be asked to enter the final 6 digits of the debit or ATM card as well as its expiry dates. Then you will receive an OTP that you need to enter and enter the UPI PIN. Be aware that ‘UPI-PIN’ is not identical to the MPIN offered by your bank to enable the mobile bank’.

Send and Receive Money

Can I transfer money to anyone via Bharat Interface to pay for it?

Yes, you can transfer money through Bharat Interface for Money. Bharat Interface for Money app using your UPI-activated bank account. You’ll need to sign up and create a UPI PIN with the debit card details that are linked to your bank account. If the bank account of your beneficiary is connected to UPI, you could make use of their mobile phone number or their payment address to transfer. If there isn’t, you could make use of the IFSC code, bank account or MMID number, or Bank account to transfer money.

Do money transfers occur via Bharat Interface For Money during bank hours?

Instant payments are available all the time, regardless of the time of day your bank is open!

I’ve made a payment for my transaction, but have not received any item. What is the reason?

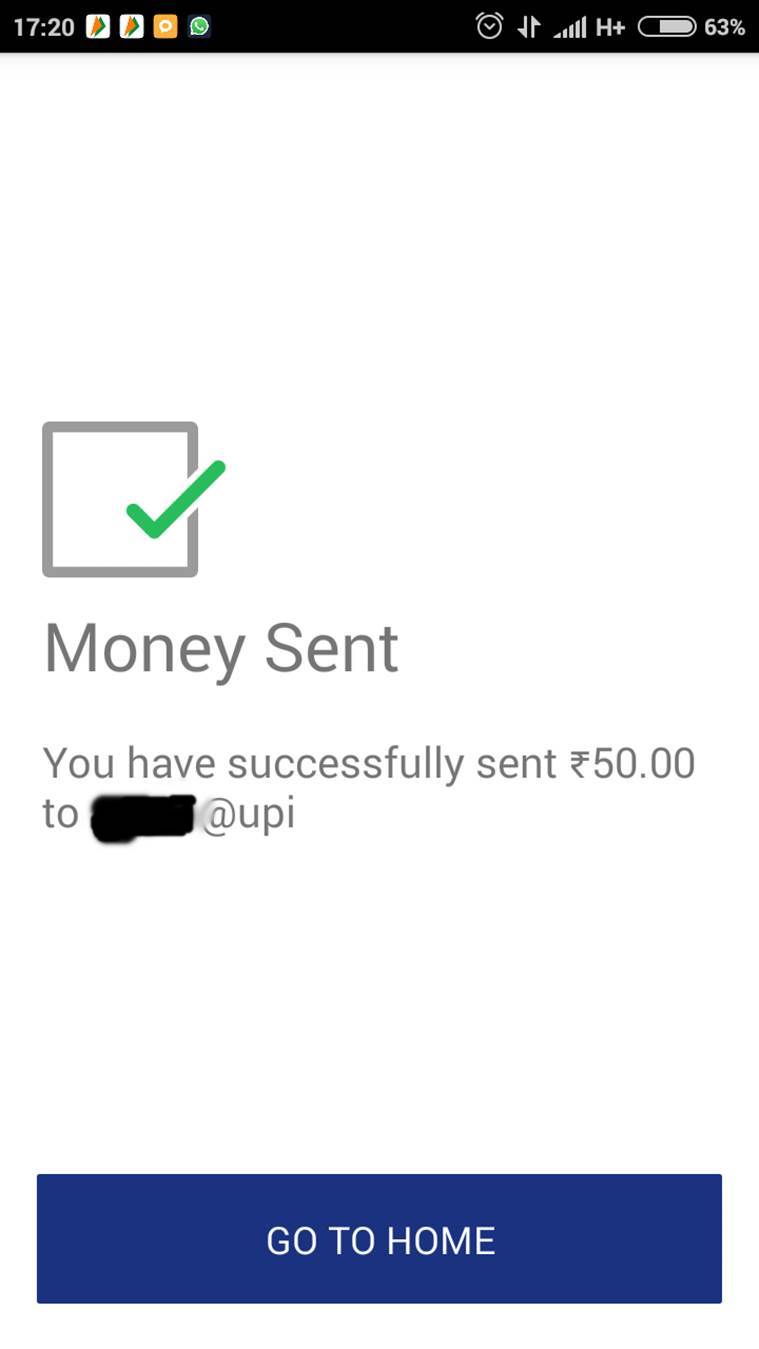

After you have completed a transaction, you will be able to get a confirmation at your Bharat Screen for Banking. You will also you will receive an SMS message from your financial institution. Sometimes, due to issues with the operator, it could take longer. If you haven’t received your confirmation within one hour, please contact us at your bank.

What can I do to view my history of transactions?

Go to Bharat Interface for Money Home Screen ->Transaction History. to see all your previous and ongoing transactions.

How can I transfer money?

On the Bharat interface for the money app’s Home screen 1.) Select Send Money 2.) Select or enter the recipient’s mobile phone number the Payment Address (you can choose from your contacts list or type the number) as well as Aadhaar number 3.) Input the total amount that you wish to send (4) The default bank account is selected 5) Enter your UPI PIN to transfer

Alternately, take a picture of a QR code to pay with the ‘Scan and Pay option.

How do I request money?

On to the Bharat interface for money Home screen 1.) Choose Request Money 2) Select or enter the mobile number of the receiver or payment address (you can choose from your contacts list or type it in) or the Aadhaar number 3.) Input the total amount that you would like to request (4) Select Send.

The transaction will be in the process until the money is received. You will be informed when the funds are sent to you. You can also request funds using your QR code. Go to Home Screen->Profile->Choose an account to get a QR code

Can I transfer money to a person who is not registered on Bharat Interface for Money?

Yes. You can pay via (IFSC or Account number) or (MMID or Mobile number) if the individual isn’t registered with Bharat Interface for Money.

What kind of trades can I make through Bharat Interface for Money?

By using Bharat Interface for Money, you can perform the following transaction: 1. Request or Send Money via Payment Address 2. Send Money to Aadhaar Number 3. Request or send money to Mobile number 4. Make Money payments through MMID Mobile No. 5. Transfer money using IFSC code and Account No. 6. Additionally, you can utilize the option of scanning and pay for merchant payments.

How can I get the records of all my transactions from the past?

Each transaction you make on your bank account will be tracked through Bharat Bank and you will be able to see your transactions from the past within the ‘Transaction History section of the Bharat Interface for Money App.

My money transfer transaction to send money has failed, please Please help!

To avoid any transaction failures,) Verify that the UPI-PIN is properly entered. 2.) When the user is not connected to Bharat Interface for Money choose to pay using IFSC instead of a mobile number.

The request for collection isn’t getting to its destination in the Bharat interface for money application. What can I do?

In this instance, you must first confirm the data connection. If you’ve entered your Payment Address in the merchant app, you should verify your Payment Address again and try the transaction again. You can check the tab for pending transactions to determine if the collect request has been received by you.

What can I do to know when my UPI transaction was successful?

If you conduct a transaction, you’ll be able to get a status instantaneously at the top of your screen. If the transaction has been delayed or in progress, the outcome will be published on Your Transaction History page with a UTR#, or bank reference code. You will also be sent an SMS by your bank.

BHIM App How to Download All Mobiles Aadhar App

BHIM App How to Download All Mobiles Aadhar App

Tags: how to download aadhar card in mobile,aadhar card download,how to download aadhar card online,how to download aadhar card,how to download aadhar card on mobile,how to download aadhar card online in mobile,aadhar card kaise download kare,how to download aadhar card online in mobile in tamil,download aadhar card,how to download aadhaar card,how to download e aadhar card online in mobile in tamil,how to aadhar card download,how to download aadhar card in tamil