PMEGP Prime Minister Employment Generation Programme Online Application Registration

The Prime Minister’s Employment Generation Programme (PMEGP) is a credit-linked subsidy scheme launched by the Ministry of Micro, Small and Medium Enterprises (MSMEs), Government of India, to provide financial assistance to entrepreneurs from the backward classes, scheduled tribes, and scheduled castes, to set up new businesses or expand existing ones. The scheme aims to promote self-employment and generate employment opportunities in the country, especially in rural areas.

Under the PMEGP scheme, the beneficiaries are provided with financial assistance in the form of loans and subsidies. The loan amount and the subsidy amount depend on the project cost, with the maximum loan amount being Rs. 25 lakhs for the manufacturing sector and Rs. 10 lakhs for the service sector. The subsidy amount ranges from 15% to 35% of the project cost, depending on the category of the beneficiary and the location of the project.

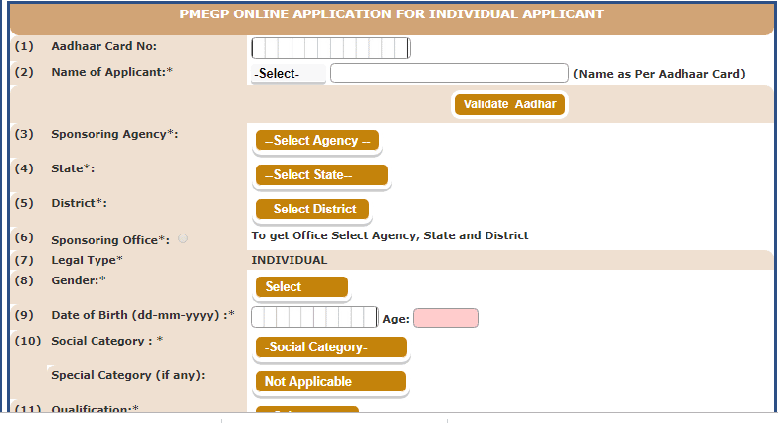

To apply for the PMEGP loan, the applicants need to register online on the official website of PMEGP (https://www.kviconline.gov.in/pmegpeportal/jsp/pmegponline.jsp). The online application process is simple and user-friendly, and it can be completed within a few steps. The applicants need to provide their personal information, project details, and bank account details in the online application form. They also need to upload the necessary documents, such as Aadhar card, PAN card, caste certificate, project report, and bank account details.

PMEGP Prime Minister Employment Generation Programme Online Application Registration

Once the application is submitted, it will be processed by the concerned authorities, and if approved, the loan amount will be disbursed to the applicant’s bank account. The applicant needs to provide collateral security for the loan amount. However, in the case of loans up to Rs. 5 lakhs, no collateral security is required.

The PMEGP scheme has some eligibility criteria that the applicants need to fulfill. The applicant should be at least 18 years old and should have completed a minimum of 8th standard. The applicant should also be a permanent resident of the state where the project is proposed to be set up. The project cost should not exceed Rs. 25 lakhs for the manufacturing sector and Rs. 10 lakhs for the service sector.

The PMEGP scheme has some advantages and disadvantages that the beneficiaries need to consider before applying for the loan. The advantages of the PMEGP scheme include:

Financial assistance: The PMEGP scheme provides financial assistance in the form of loans and subsidies to the beneficiaries, which is helpful in setting up new businesses or expanding existing ones.

Employment generation: The PMEGP scheme promotes self-employment and generates employment opportunities in the country, especially in rural areas.

Skill development: The PMEGP scheme provides training and skill development programs to the beneficiaries, which helps them in running their businesses successfully.

Easy application process: The online application process of the PMEGP scheme is simple and user-friendly, which makes it easier for eligible candidates to apply for the loan.

The disadvantages of the PMEGP scheme include:

Collateral security: The beneficiaries need to provide collateral security for the loan amount, which can be difficult for some applicants.

Limited loan amount: The loan amount provided under the PMEGP scheme is limited, which may not be sufficient for some business ventures.

Eligibility criteria: The PMEGP scheme has some strict eligibility criteria, which may exclude some potential applicants.

Lengthy process: The application process for the PMEGP scheme can be lengthy, which may discourage some potential applicants.

made it easier for eligible candidates to apply for the loan, and the scheme provides various advantages to the beneficiaries, such as financial assistance, employment generation, and skill development. However, the scheme also has some disadvantages, such as collateral security, limited loan amount, strict eligibility criteria, and a lengthy application process, which may deter some potential applicants.

To address these issues, the government has taken several measures to improve the PMEGP scheme and make it more accessible to the targeted beneficiaries. For instance, the government has simplified the application process by introducing a single-page application form, reducing the processing time, and enhancing the transparency of the process. The government has also increased the loan amount and the subsidy amount under the scheme and made it mandatory for banks to provide collateral-free loans up to Rs. 10 lakhs to the PMEGP beneficiaries.

PMEGP Prime Minister Employment Generation Programme Online Application Registration

Furthermore, the government has launched various skill development and training programs to enhance the entrepreneurial skills of the PMEGP beneficiaries and make them self-reliant. These programs cover various aspects of business management, such as marketing, accounting, production, and quality control, and they are provided by reputed institutes and organizations across the country. The government has also established a network of Common Facility Centers (CFCs) to provide common infrastructure and support services to the PMEGP beneficiaries, such as testing labs, design centers, raw material banks, and marketing outlets.

The PMEGP scheme has been successful in creating a large number of employment opportunities and promoting entrepreneurship among the backward classes, scheduled tribes, and scheduled castes. According to the data released by the Ministry of MSMEs, more than 5 lakh PMEGP projects have been sanctioned since the launch of the scheme, and more than 35 lakh jobs have been created through these projects. The scheme has also contributed to the overall growth of the MSME sector in the country, which is a crucial driver of the Indian economy.

In conclusion,

The PMEGP scheme is a vital initiative of the government to promote self-employment and generate employment opportunities in the country, especially in rural areas. The scheme provides financial assistance, training, and support services to the beneficiaries and helps them in setting up new businesses or expanding existing ones. However, the scheme has some limitations, and the government needs to address these issues to make it more accessible and effective for the targeted beneficiaries. Overall, the PMEGP scheme is a significant step towards inclusive and sustainable development, and it has the potential to transform the lives of millions of people in the country.